Kate and her mom were going shopping for school supplies. Kate had her mind set on exactly what she wanted. She’d even scribbled a list of all the things she was going to buy at the store.

Kate and her mom were going shopping for school supplies. Kate had her mind set on exactly what she wanted. She’d even scribbled a list of all the things she was going to buy at the store.

“And can’t I get that?” she asked, pointing at the sequined pencil case her best friend Lori had told her about.

“Oh, Kate,” her mom groaned. “We can’t buy the most expensive of every supply on your list!”

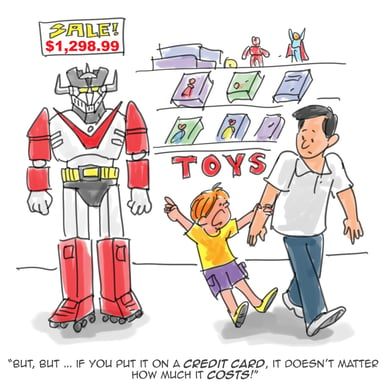

Kate was stumped. “But why not?” she asked. “If it’s too much money, you can just put it on your credit card!”

Mom gave her a look, and then said under her breath, “Let’s talk about this a little later, at home. Meanwhile, let’s try to find all of your supplies at decent prices.”

Kate agreed and they finished shopping without any more arguments.

***

After they’d gone home and put away all of Kate’s supplies, Mom prepared two tall glasses of lemonade. She sat down at the kitchen table, across from Kate.

“Let me explain how it works, Kate,” she said. “A credit card isn’t ‘free money.’”

Kate yawned. “I know, I know—you get a bill at the end of the month and you need to pay it all back.”

Mom nodded. “Exactly. But there’s a few things you don’t know about credit cards.”

“Like what?”

“First of all,” said Mom, “lots of credit cards cost money just to have. It’s called an ‘annual fee.’ Also, credit cards don’t lend you that money for free. They charge you interest on every purchase you make.”

“Interest?”

“That means extra money, a certain percentage of the purchase that you need to pay to the credit card company.”

“So it really costs you more than the price!” Kate broke in.

“Exactly,” Mom smiled. “You won’t have to pay the interest if you pay the full amount on your bill on time, but most people don’t. And then they end up paying for that one little purchase for months—or even years and years!”

“So, if the best way to use a credit card is to pay up your full bill each month, why have one at all?” Kate asked. “Why not just use cash?”

“That’s a great question,” Mom said. “There are two main reasons people have credit cards other than to help them pay for stuff they can’t really afford,” she explained. “One is to get the rewards. Lots of credit cards offer points and money back for specific purchases you make on the card.”

“Cool!” said Kate. “Like a bonus for spending money?”

“Right,” said mom. “But it sometimes can get out of control and people spend more than they planned just because they’re getting some points out of the deal. So it doesn’t quite work out as planned. Plus, lots of rewards cards have an annual fee, so they’re expensive just to have.”

“Wow,” Kate said. “And what’s the second reason?”

Mom reached into her wallet and pulled out her credit card. “You see this?” she asked. “This helped me buy our house!”

Kate’s eyed bulged. “You can buy a house on a credit card?”

Mom threw back her head and laughed. “No, Kate,” she said. “Let me explain. Let’s say someone has a bunch of open credit cards but they’re super-careful with how they use them. They’re always careful about paying their balance on time and they never rack up huge bills. What does that say about them?”

“They’re responsible!” Kate said. “They know how to pay back what they borrow and they don’t spend too much money.”

“Exactly!” Mom smiled. “So when someone wants to take out a huge loan—like a loan that will help them buy a house, the people lending them that money will look at the way they use their credit cards. It’s called their credit history and credit score. The person’s credit history will tell the borrower about their credit card use in the past, and their credit score is like a grade which shows how responsible they’ve been with their credit. Are you following?

Kate nodded. “I think so.”

“So, why do you think the lender will look at their credit history and credit score when deciding if they will lend this person money to buy a house?”

“Because they want to make sure the person will pay them back!” Kate exclaimed.

“You’re catching on really quickly,” Mom grinned. “I was always very careful with my credit cards, and that helped us get a mortgage for this house!”

“Wow,” Kate said. She had a lot to think about. “What do you say we open a credit card for me, Mom?” She asked. “I want to start building my credit score right now!”

Talking points:

- Can you explain the way a credit card works?

- Why do you think credit card companies let people borrow so much money from them?

- Are credit cards a good way to purchase something you can’t afford? Why, or why not?